In India, the real estate sector is the second-highest employment generator, after the agriculture sector. It is also expected that this sector will incur more non-resident Indian (NRI) investment, both in the short term and the long term. Bengaluru is expected to be the most favoured property investment destination for NRIs, followed by Ahmedabad, Pune, Chennai, Goa, Delhi and Dehradun.

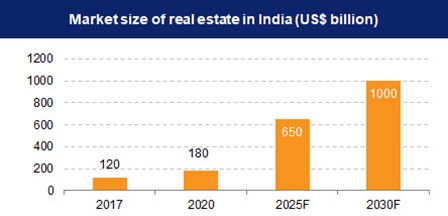

Over the last few years, India’s real estate sector has grown manifold and seized various challenges. According to Indian Brand Equity Foundation, the real estate market is expected to grow further to Rs. 65,000 crore (US$ 9.30 billion) by 2040 from Rs. 12,000 crore (US$ 1.72 billion) in 2019. The increasing market size is likely to contribute 13% to the country’s GDP by 2025.

Despite the countless disruptions in the last few years, several factors have led to a huge transformation and the government has been focused towards making housing affordable and available to everyone. There has been increased focus on sustainability, adoption of technology, better building specifications and supportive government policies. Furthermore, sustainability will be key aspect in attaining significant reduction in operational costs and carbon footprint.

Meanwhile, the growth is well complemented by the advancement in the corporate environment and the rising demand for office space as well as urban and semi-urban accommodation. From an investment standpoint, this sector is expected to experience more non-resident Indian (NRI) investment.

There has been increased transparency due to reforms including Goods and Services Tax (GST) and Real Estate (Regulation and Development) Act (RERA). Thus, NRI buyers now experience more simplified format of engagement by trustworthy developers and properties currently registered under RERA.